Important takeaways

- XRP rose 10% to $2.3 on the first day of trading in 2025.

- XRP dominated trading volumes over Bitcoin and Ethereum in South Korea.

XRP has started the new year with a strong performance, gaining 10% in the last 24 hours and reclaiming the $2.3 mark last seen on December 26, according to CoinGecko data.

The rally comes at a time when most major crypto assets remain relatively flat. Bitcoin is currently trading around $94,000 with minimal movement, while other leading crypto assets such as Ethereum, Binance Coin and Solana are showing little price action.

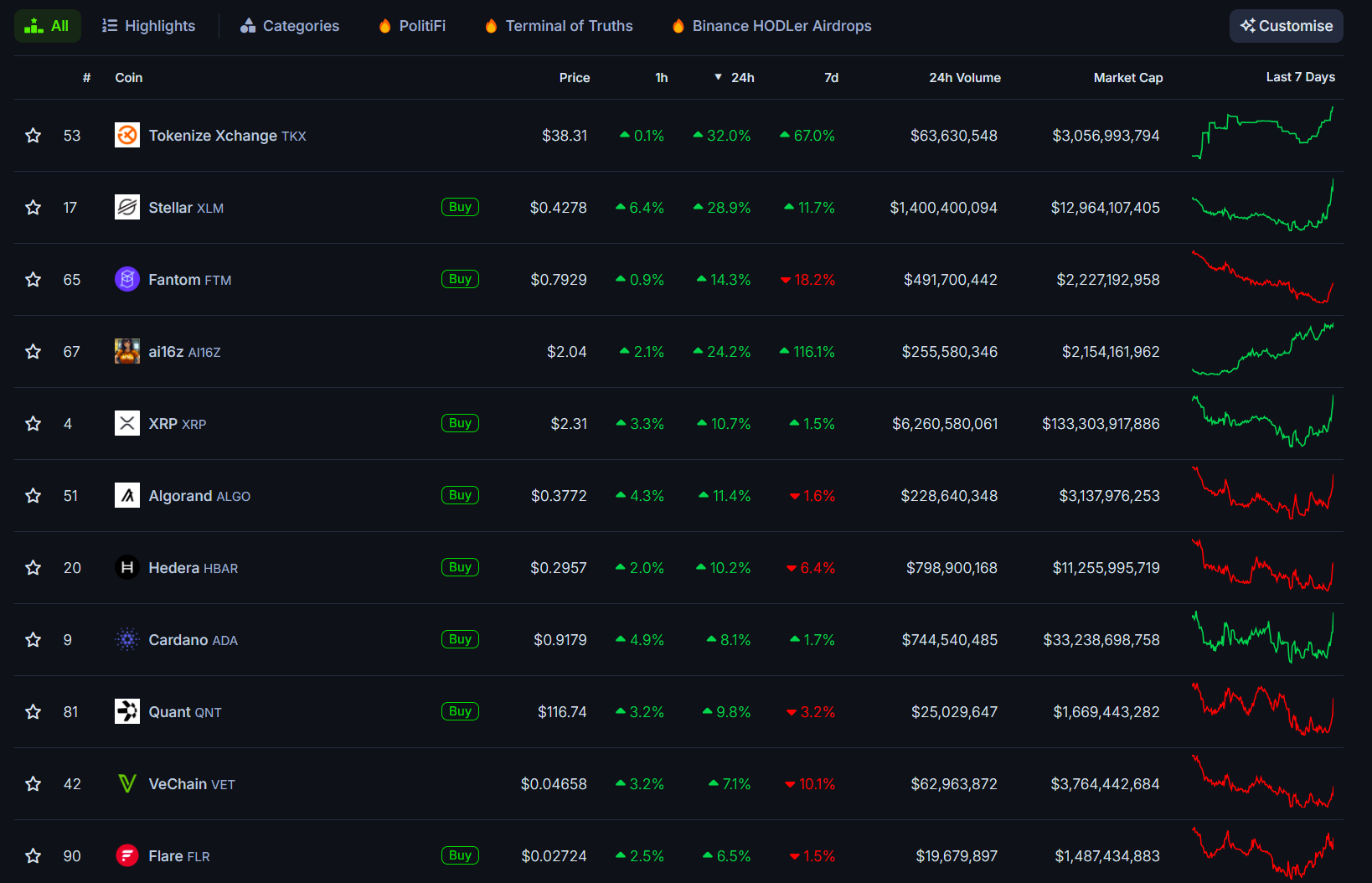

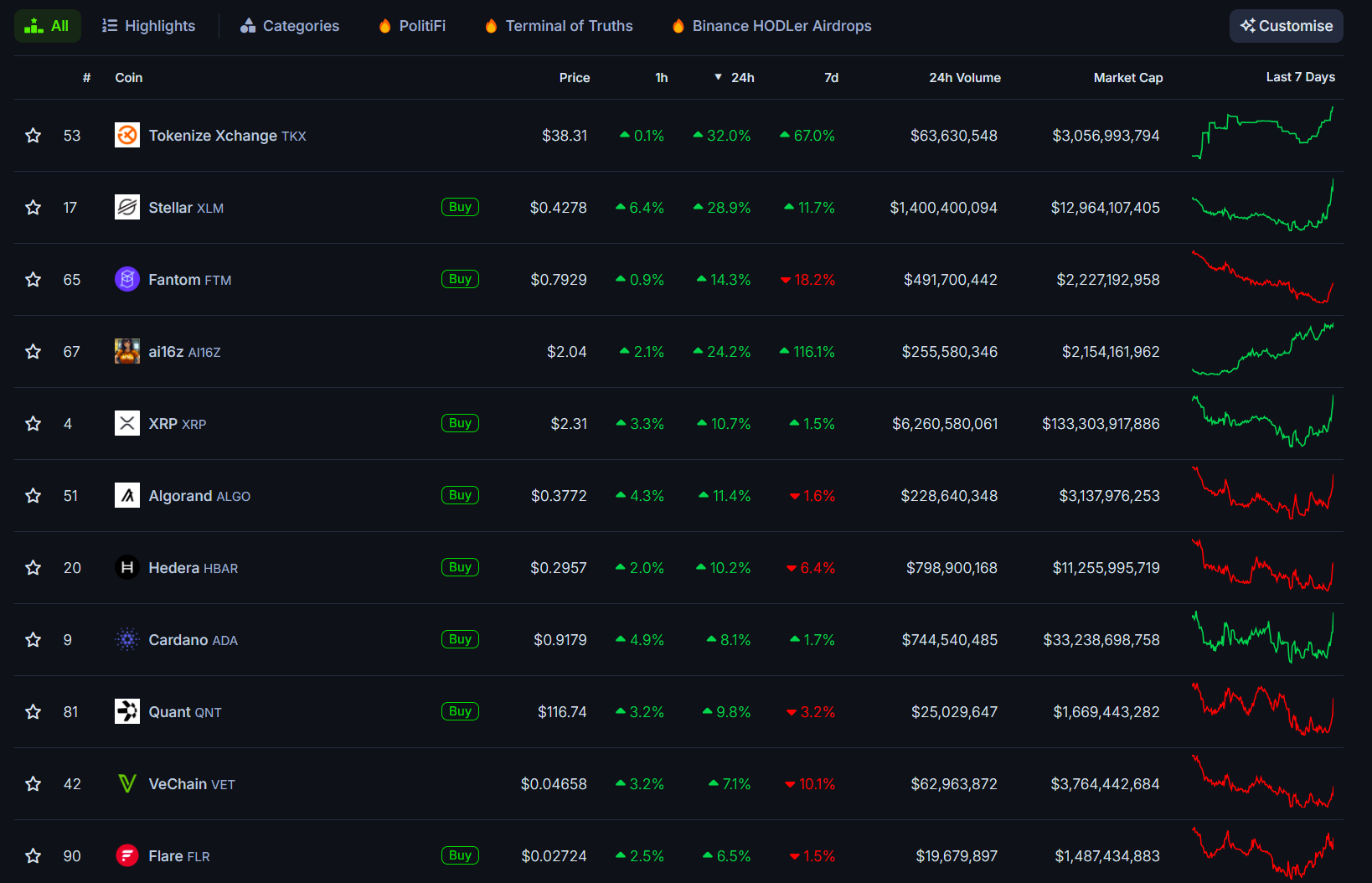

In contrast, established altcoins including Tokenize Xchange (TKX), Stellar (XLM), Fantom (FTM) and Algorand (ALGO) have made double-digit gains over the past 24 hours. Some major crypto assets by market capitalization such as Hedera (HBAR) and Cardano (ADA) have also seen significant increases.

The AI16Z token, which recently became the first AI coin on the Solana blockchain achieve a market capitalization of USD 2 billionincreasing their profits. Currently trading above $2, the token has risen 21% in the last 24 hours, placing it among the top daily gainers.

XRP trading volumes rise in South Korea

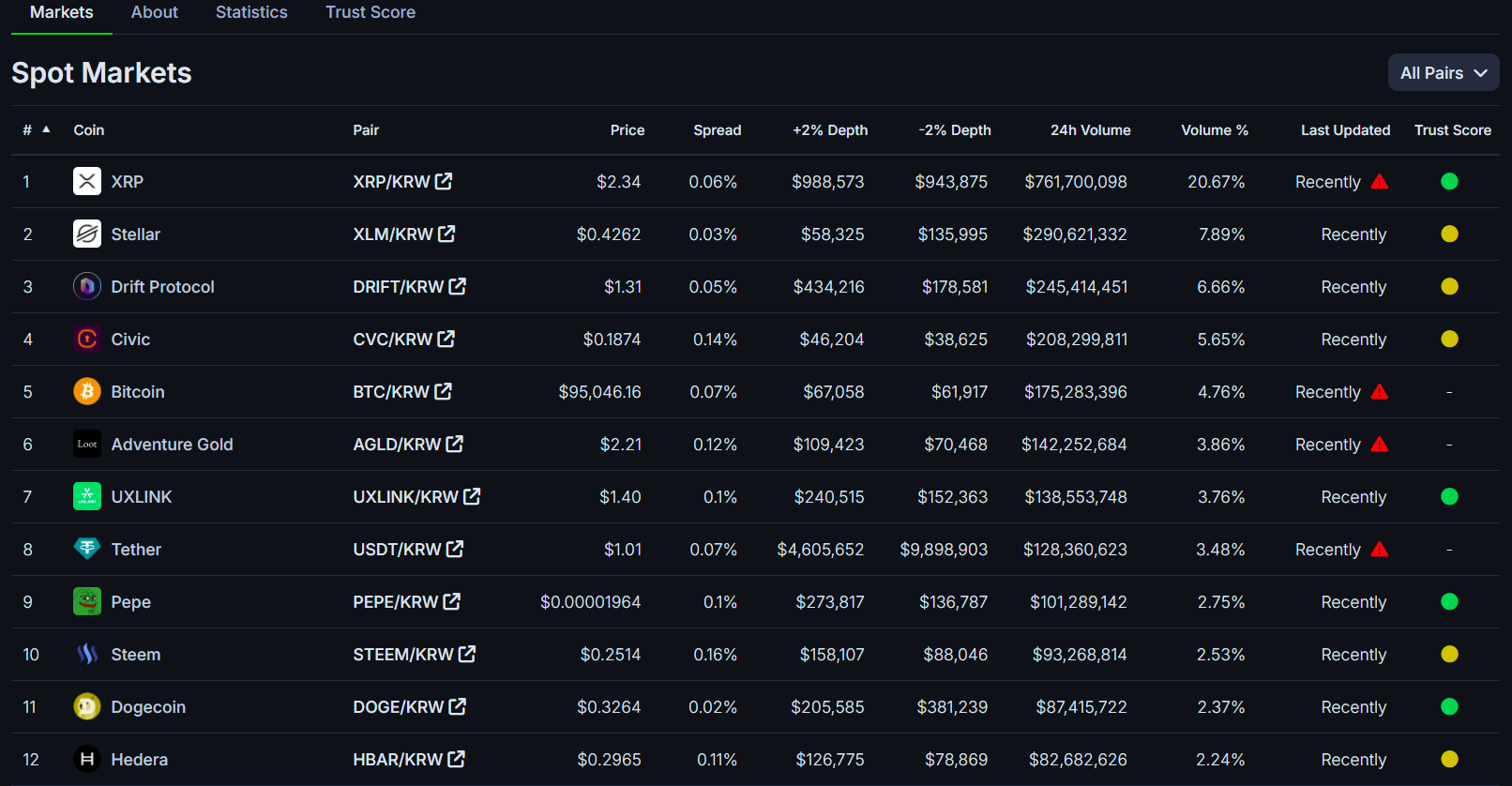

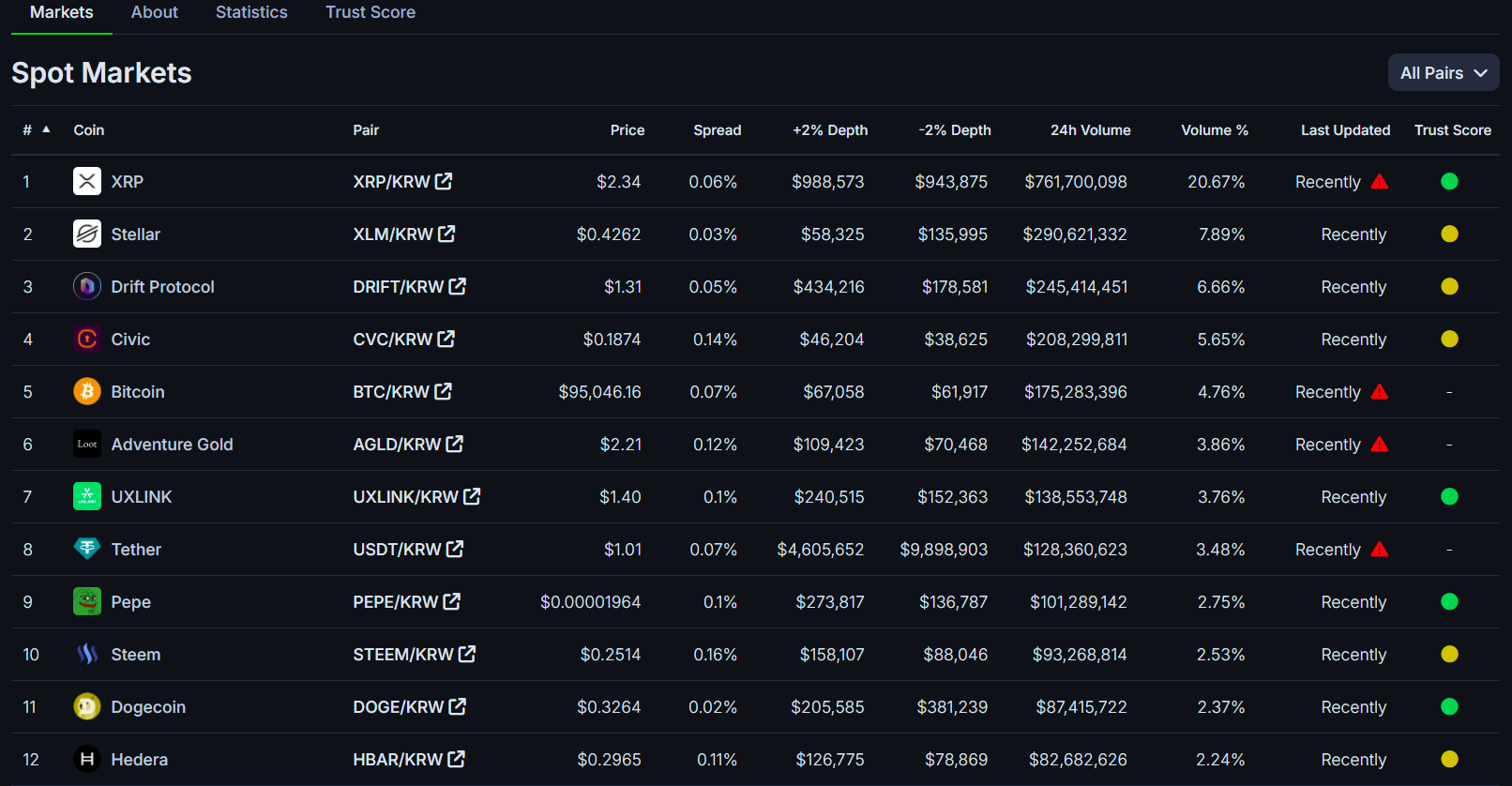

In South Korea, XRP trading volumes have surpassed both Bitcoin and Ethereum across the country’s major exchanges.

The combined trading volume against won on Upbit, Bithumb and Korbit exceeded $1 billion in the last 24 hours, with XRP recording $254 million on Bithumb and $761 million on Upbit.

High trading volume indicates greater market interest in the asset, indicating that many investors are actively buying and selling.

Changes in trading volume can signal potential trend reversals or continuations. High trading volumes can also lead to increased volatility in the market, as large orders can affect prices.

The increase in volume comes amid political developments in South Korea, where a court issued an arrest warrant for President Yoon Suk Yeol on Tuesday over his martial law ruling in December.

Trump’s inauguration, SEC chairman’s resignation in over two weeks

Trump’s inauguration as America’s 47th president is scheduled for January 20. Also that day, SEC Chairman Gary Gensler will resign.

Trump’s arrival and Gensler’s departure are expected to pave the way for a change in the regulatory approach to the crypto sector, which has long faced hostility under the current administration.

For the Ripple community, these events could bring an end to the year-long legal battle between Ripple and the US securities watchdog, potentially resulting in either a settlement or dismissal of the case. A resolution is expected to clarify XRP’s legal status and set a precedent for other crypto assets that have also been classified as securities by the SEC.

Additionally, as the regulatory landscape in the US matures, meaning more guidance and clarity, there is hope that one or more spot XRP ETFs, along with a wave of other crypto ETFswill secure regulatory approval.

As of January 1st, several fund managers – including Bitwise, Canary Capital, 21Shares and WisdomTree – are in line for approval to launch their respective XRP ETFs.

Any developments in either the XRP ETF’s progress or the SEC-Ripple case are expected to significantly affect XRP’s price movements.