Important takeaways

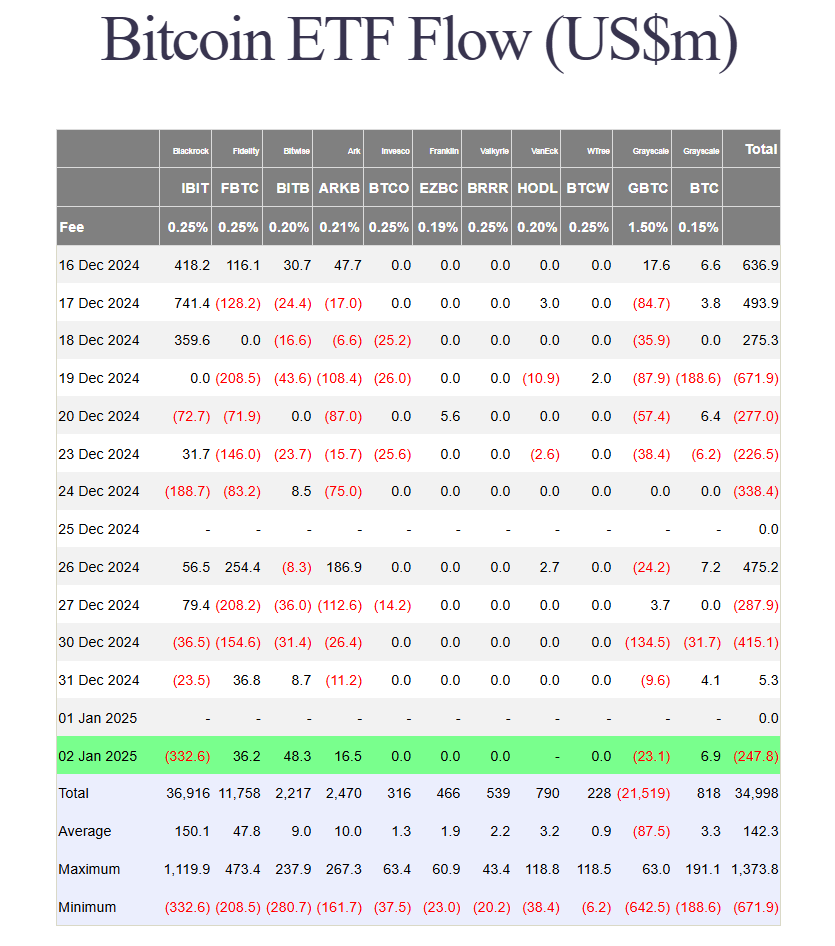

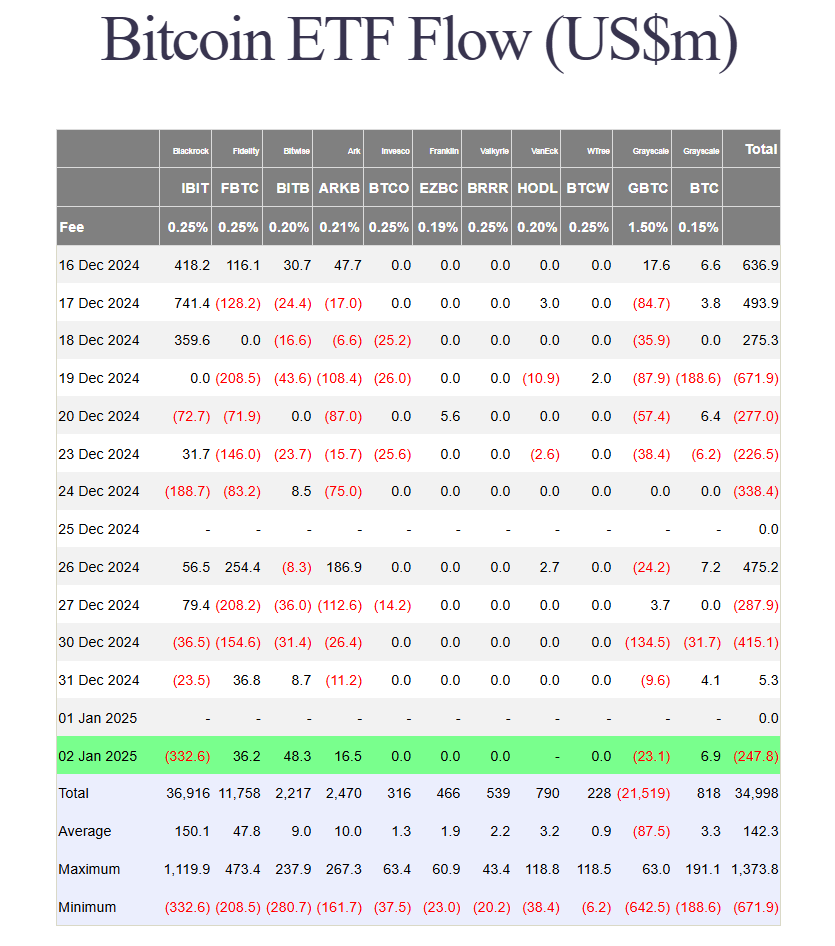

- BlackRock’s IBIT experienced a record one-day outflow of $332 million on January 1st.

- US spot Bitcoin ETFs collectively faced outflows of $650 million for the week.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded its largest one-day outflow of over $332 million on Jan. 1, surpassing its previous record of $188 million set on Dec. 24, according to updated data from Farside Investors.

The massive IBIT withdrawals pushed the US spot Bitcoin ETF’s overall flows into red territory on Thursday, even as most rival ETFs posted gains. Grayscale Bitcoin Trust (GBTC) also saw losses of nearly $7 million.

Bitwise Bitcoin ETF (BITB) led daily inflows with $48 million, followed by Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin (ARKB) and Grayscale Bitcoin Mini Trust (BTC). Those funds collectively took in about $108 million on Thursday.

Excluding Valkyrie’s Bitcoin ETF, the 10 US-based spot Bitcoin ETFs recorded a combined outflow of $248 million. Total net outflows for the week have exceeded $650 million.

IBIT’s total net outflows have reached $392 million since December 3, marking three consecutive trading days of losses. Despite the recent outflows, the fund remains the dominant Bitcoin ETF, with nearly 552,000 BTC valued at over $51 billion as of January 2nd.

Launched in early 2024, IBIT outperformed the vast majority of ETFs throughout the year. The fund ranked third on Bloomberg ETF analyst Eric Balchuna’s 2024 top list with about $37 billion in year-to-date flows, trailing only established index giants VOO and IVV.

Here is the final 2024 Top 20 ETF Scoreboard: $VOO ended with $116b which is $65b beyond old records (absurd). $ IVV closed strong w $89b (bc used more than $SPY for TLH?). $ GOING took 3rd place with $37b (still <1 year old!). Total flows of $1.14T, beating old record by 25%, or $225b..🔥🔥 pic.twitter.com/RRCbHEAN9Q

— Eric Balchunas (@EricBalchunas) January 2, 2025