Bitcoin (BTC) market was very hooked during the past week, with prices that jumped by over 10%. In the midst of this positive development, it has been remarkable investor activity, which points to an unmatched demand that can support long -term price development.

BTC Supply Shake-up: Long-term holders are increasing, new buyers steps above $ 92K

In a recent x postPopular Crypto Pundit Axel Adler Jr. shared some interesting insights into the chain in the Bitcoin market.

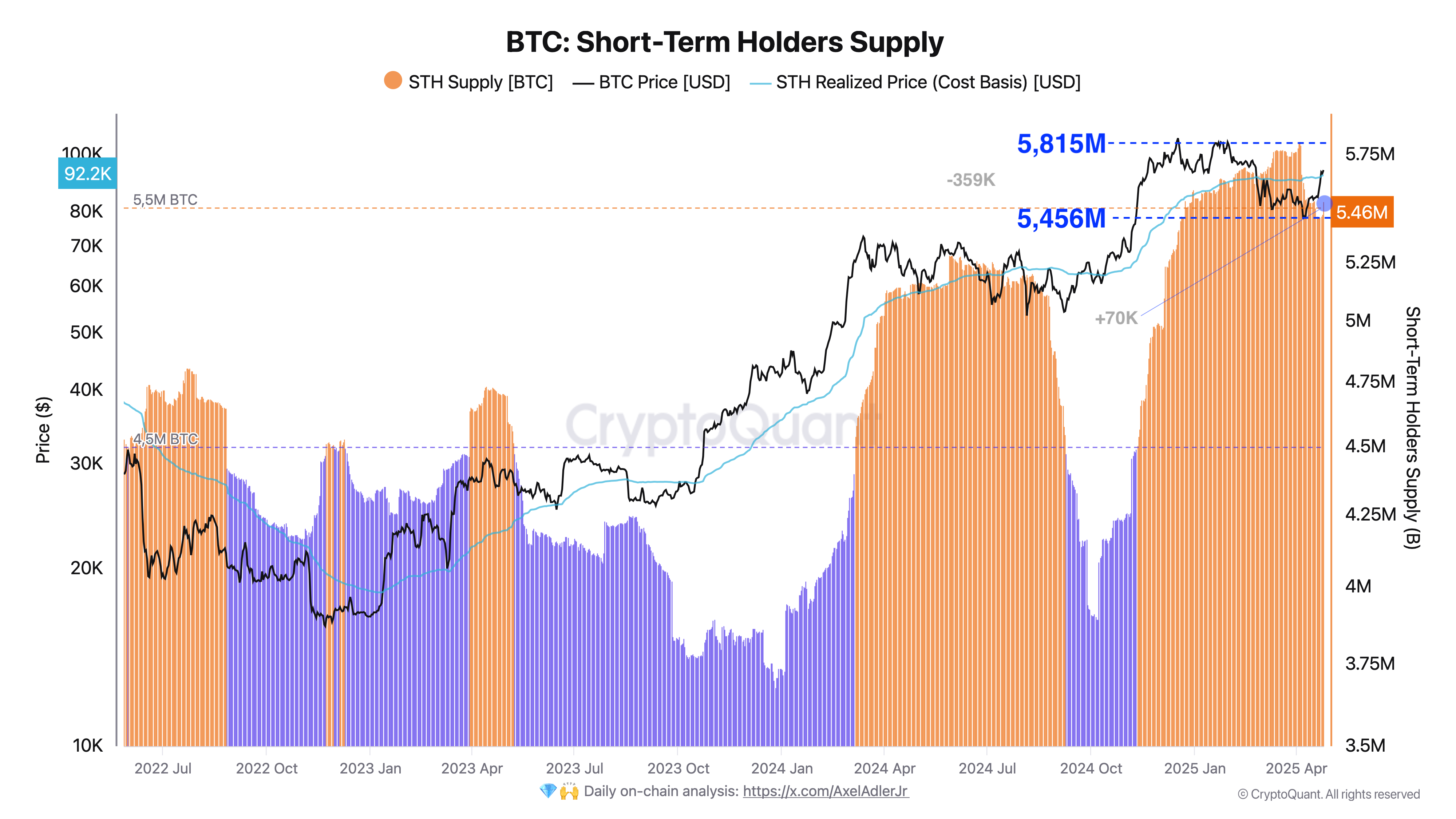

With the help of data from Cryptoquant, Adler reports that the market supply for short-term holders decreased by 359,000 BTC, valued to $ 33.84 billion, for 16 days between April 4-21. Interestingly, this downturn was not due to sales printing but rather coin maturity, which resulted in a transition to the long -term holder category.

This is a positive market signal that indicates that holders are secure in Bitcoin’s long -term prospects. By choosing to sell, the holders strengthen the underlying market demand and provide a solid basis for future price collections.

In another interesting development, Axel Adler JR also noted that BTC short -term holders’ offerings increased by 70,000 BTC, valued at $ 6.59 billion, in the last two days after Bitcoin’s latest prize rally.

The analyst explains that this increase resulted from profit -making of long -term holders via redistribution When prices climbed. It is important that short-term holders have effectively absorbed this new supply and signals a strong demand in the Bitcoin market.

This demand is strongly reflected in Bitcoin’s ability to remain over $ 92,200, the short -term holders’ cost base, which represents the average acquisition price for their holdings. This indicates a robust marketing believer when new buyers aggressively go out on the market and expand sth cohort.

Overall, the combination of significant coin maturity, healthy redistribution and bitcoin resistance over the cost of the short -term holders a structurally strong market needs. With long -term holders showing confidence and a new demand that effectively absorbs the supply, BTC seems well positioned for a long -term speed close to the middle of the term.

Bitcoin price overview

At the time of writing, Bitcoin deals with $ 94,408, which reflects a decline of 0.78% on the last day. However, the daily asset trade volume decreases by 55.53%, which indicates a declining market participation.

Nevertheless, BTC looks to retain its price development after moving past Greater resistance level to $ 91,000Supported by other hausse -like developments, including a revival in ETF inflows A total of about $ 3.06 billion over the past week.

The next resistance is $ 96,000 and moves by, which can pave the way for a further price increase to about $ 100,000. However, a price repellent can force a return to about $ 92,000, which effectively creates a range of movement.

The picture from The Economic Times, charts from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.