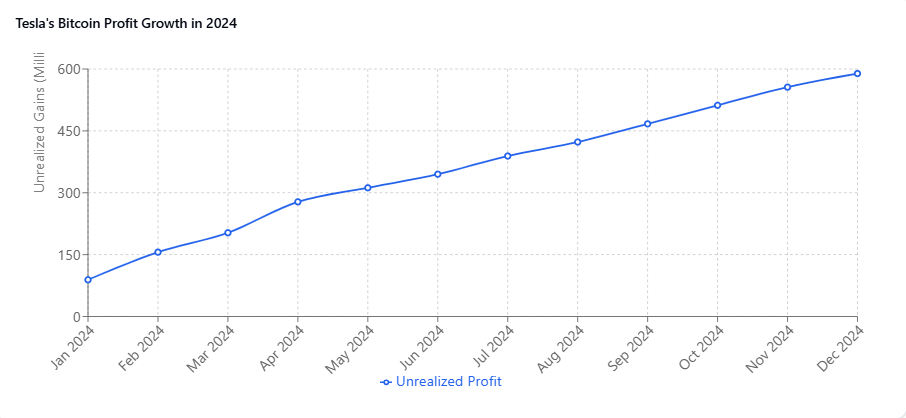

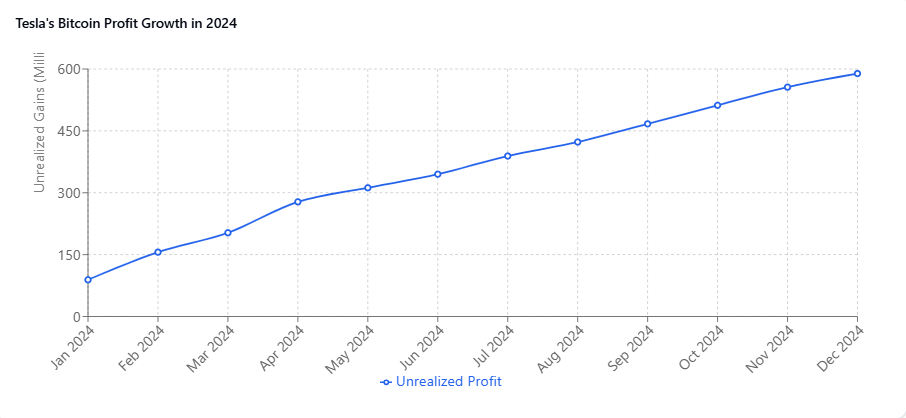

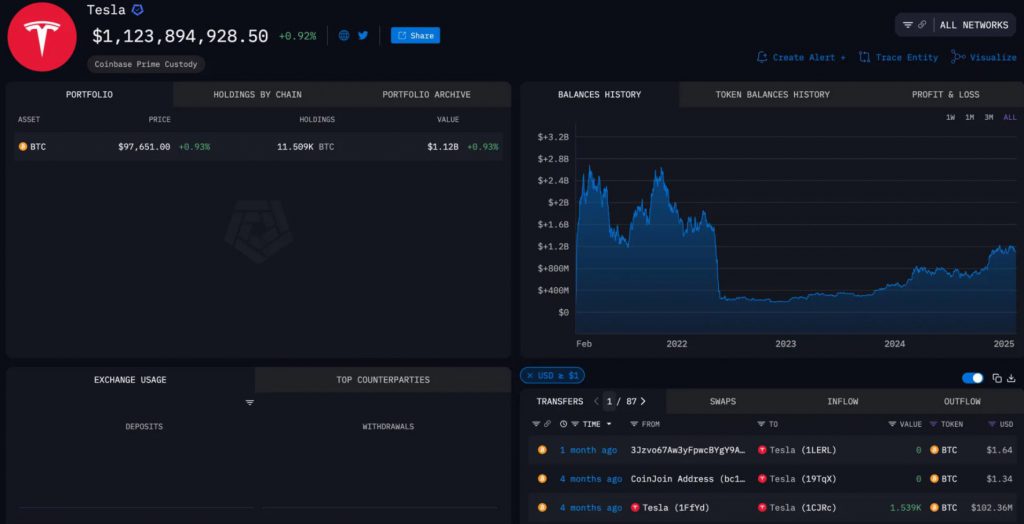

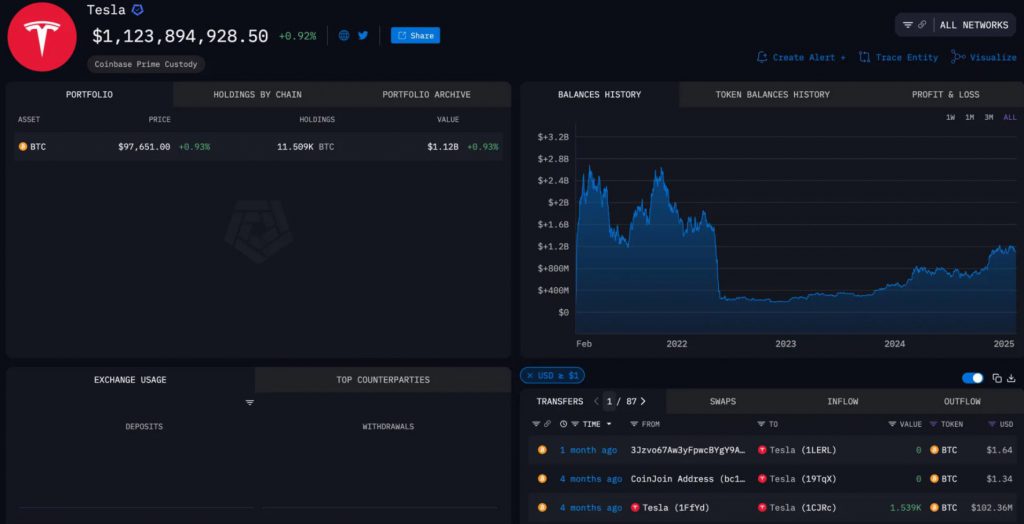

Tesla Bitcoin Holdings has reached a significant milestone as the company’s SEC archiving Reveals the ownership of a huge 11,509 BTC, valued at over $ 1 billion right now. The electrical vehicle manufacturer’s crypto investments show a remarkable profit growth, while Bitcoin feels the effects of market volatility, with a reported unrealized $ 589 million profit according to new accounting standards. These Tesla Bitcoin Holdings represent one of the largest companies’ Cryptocurrency positions on the market.

Also read: Top 3 Crypto courses predicted to hit new peaks soon

Understand Tesla’s Bitcoin holding and impact on market vollatility

Q4 2024 Profit monitoring

FASB rule changes Transform reporting

There were some important changes in the guidelines for the Financial Accounting Committee that have succeeded in changing how Tesla’s crypto investment is reported. Some new rules from December 2024 Let Tesla View Bitcoin Holdings at their current market value.

The SEC archiving indicated the following:

“Other incomes (cost), net, changed positively by $ 523 million during the year ended on 31 December 2024 compared to the year ended on December 31, 2023 mainly due to reinforcement of our Bitcoin digital assets at fair value in 2024, partially compensated by by unfavorable fluctuations in exchange rates for foreign currencies on our inter -company balances. “

Also read: XRP: When will Ripples fall with the US SEC end?

Portfolio management strategy

What does the future have?

While Tesla sold most of its early Bitcoin investments, their current Tesla Bitcoin holding shows strong results. Several experts point to new accounting rules and bitcoin market vollatility as important success factors. Several indicators indicate that Bitcoin profit growth continues to improve Tesla’s economy as some large institutions accept Cryptocurrency.

Also read: Cardano jumps 15.7% in 24 hours: Will Ada hit $ 1 this week?